Seahold's provision of plaintiff financing for personal injury clients encompasses more than just financial assistance; it embodies a commitment to empowering individuals to pursue justice. Beyond mere monetary support, Seahold offers the resources necessary for clients to navigate the often arduous journey of legal proceedings with determination and confidence. By extending financial backing, Seahold enables clients to not only address immediate needs but also to sustain themselves throughout the entirety of their legal battles.

his comprehensive support ensures that individuals have the means to persist until they secure the compensation and justice rightfully owed to them. In essence, Seahold's services are a testament to their dedication to helping clients go the distance in their pursuit of what they rightfully deserve.

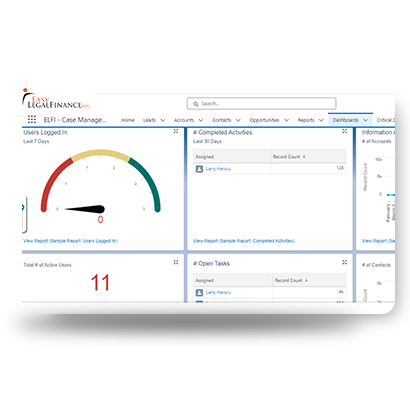

Seahold prioritized streamlining their funding and monetary operations to enhance efficiency and accuracy. By implementing optimized processes and workflows, they minimized redundancies and errors, ensuring a smoother flow of funds throughout their operations. Additionally, Seahold recognized the importance of providing relevant stakeholders with real-time insights into financial data. To address this, they developed a sophisticated financial front-end dashboard tailored to meet the specific needs and preferences of concerned personnel. This dashboard not only consolidated essential financial information but also presented it in a user-friendly interface, enabling quick access to critical metrics and facilitating informed decision-making. Through these initiatives, Seahold demonstrated their commitment to operational excellence and responsiveness to the needs of their team members involved in financial management.

Monitoring quarterly revenue growth in plaintiff financing proves challenging due to fluctuating caseloads, settlements, and market conditions. Seahold must deploy robust tracking systems and analytics tools to make informed decisions and optimize financial performance. Managing funding at scale demands efficient processes; automation is key to handling increasing client volumes while minimizing errors and ensuring compliance. Providing partners with detailed financial dashboards requires Seahold to develop sophisticated interfaces that offer real-time access to accurate data. Ensuring data accuracy, security, and accessibility across platforms enhances transparency and trust in Seahold's operations.

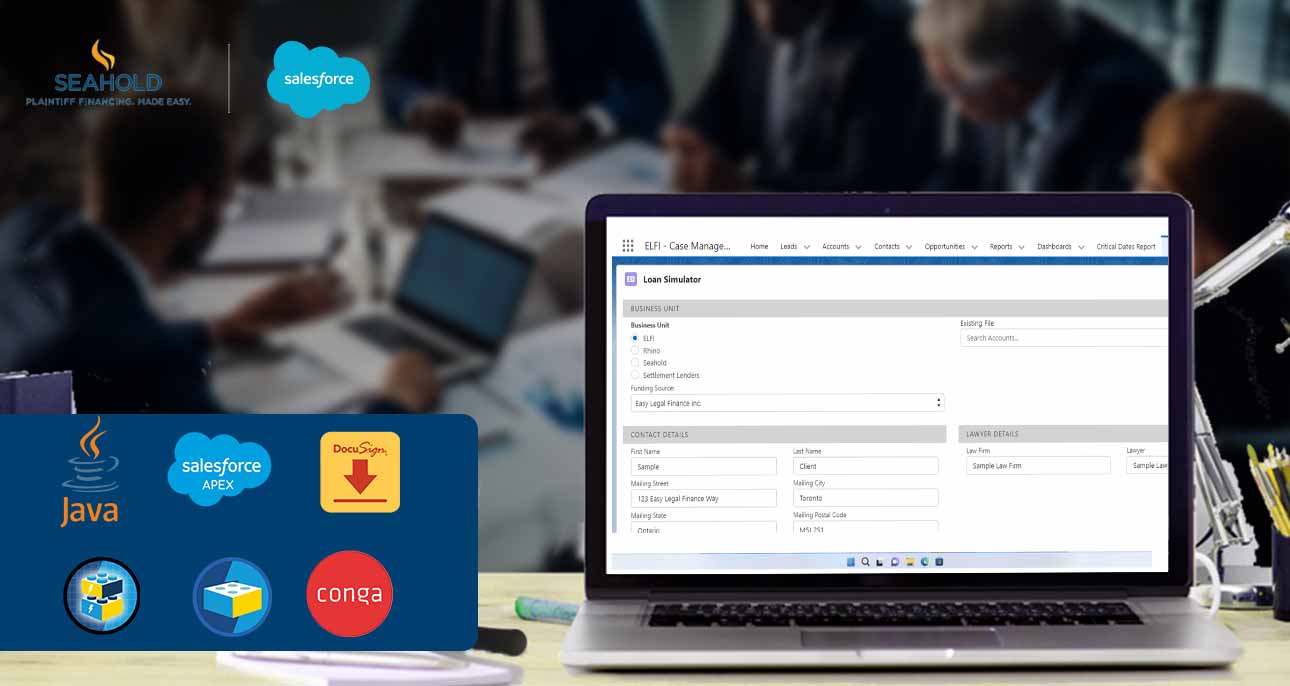

Seahold's approach to data visualization involved creating vibrant and engaging graphs and charts tailored to specific user needs. By utilizing colorful and visually appealing representations, they ensured that users could easily interpret complex financial data. Additionally, Seahold integrated APIs from two distinct banks using Apex and lightning web components, facilitating seamless data exchange and enhancing efficiency in financial transactions. To mitigate risks, they implemented approval processes to prevent undesirable transactions, demonstrating a commitment to financial integrity and security. Furthermore, Seahold invested in the development of numerous illustrations to vividly depict various aspects of the data, fostering better comprehension and decision-making among stakeholders. This comprehensive approach underscores Seahold's dedication to leveraging technology and design to optimize financial operations and enhance user experience.