VTN Global offers businesses a seamless solution for international money transfers, enabling them to send funds to banks, accounts, and mobile wallets across more than 124 countries. What sets VTN Global apart is its ability to facilitate these transactions without necessitating any physical presence or operations in the recipient countries. This means that businesses can expand their global reach and conduct financial transactions without the need to establish local infrastructure, thereby saving considerable time and resources. By leveraging VTN Global's services, businesses can streamline their operations, reduce overhead costs, and focus on their core activities while enjoying efficient and cost-effective cross-border payments.

TN Global's innovative approach to international money transfers empowers businesses to operate more efficiently, expand their global footprint, and capitalize on opportunities in diverse markets, all while minimizing the complexities and costs traditionally associated with cross-border transactions.

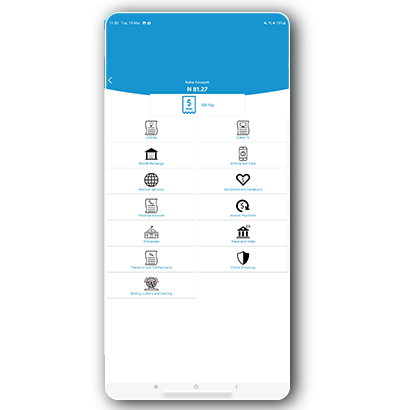

By enabling individuals in Nigeria to conduct international money transfers, the company experienced a significant boost in revenue. Introducing this feature allowed the organization to tap into a broader market and cater to the needs of users worldwide. Furthermore, by offering a platform for bill payments through the Vcash app, the company streamlined processes and expanded its market share. This shift from manual bill payments to digital remittances enhanced user convenience and solidified the company's position in the market. Overall, these innovations contributed positively to the company's financial performance and competitive standing.

Developing a dedicated app development team, ensuring robust IT support, and maintaining these systems pose significant challenges. Additionally, handling sensitive client data, including debit/credit card details, demands stringent security measures to prevent breaches. Limitations in transactions, whether between countries or banks, introduce complexities and potential delays. Managing transaction and security protocols across diverse banking systems in different countries can be exceedingly difficult. Vcash, specifically, grapples with securing communication between its server and mobile app, highlighting the critical need for robust encryption and authentication mechanisms to safeguard sensitive information effectively. Addressing these challenges requires a comprehensive approach that encompasses technology, regulatory compliance, and risk management strategies to ensure the integrity and security of financial transactions.

To address the challenges, we implemented stringent security measures to safeguard user data, employing advanced algorithmic techniques for encryption and data protection. Additionally, we forged partnerships with a wide array of financial institutions globally, ensuring compliance with secure transaction protocols to overcome trade limitations. By establishing secure communication channels and adhering to industry-standard security practices, we mitigated risks associated with cross-border transactions and enhanced the integrity and reliability of our services. This proactive approach not only bolstered user trust but also facilitated seamless and secure financial transactions across diverse banking systems and geographical boundaries, ultimately ensuring the confidentiality and integrity of sensitive user information while promoting operational efficiency and compliance with regulatory requirements.